Veteran Affairs (VA) loans are a valuable resource for military veterans looking to purchase a home. These loans come with significant benefits such as no down payment, no private mortgage insurance (PMI) requirement, and generally lower interest rates. However, navigating the VA loan process can be challenging without the right information and preparation.

First, it is crucial to understand the eligibility requirements for a VA loan. Veterans, active-duty personnel, and certain members of the National Guard and Reserves may qualify. Typically, a Certificate of Eligibility (COE) is required, which verifies your service history and eligibility status. Obtaining this certificate is a straightforward process and can be done online or through your lender.

Once eligibility is confirmed, it's important to secure a lender experienced with VA loans. Not all lenders offer VA loans, and those who do may not be equally familiar with the program's intricacies. A lender with VA expertise can provide guidance specific to your financial situation and service history.

The next step involves getting pre-approved for a mortgage. A pre-approval not only demonstrates to sellers that you are a serious buyer but also helps you understand your budget and potential monthly payments. Remember, while VA loans don’t mandate a down payment, putting some money down could help reduce the loan’s interest rate.

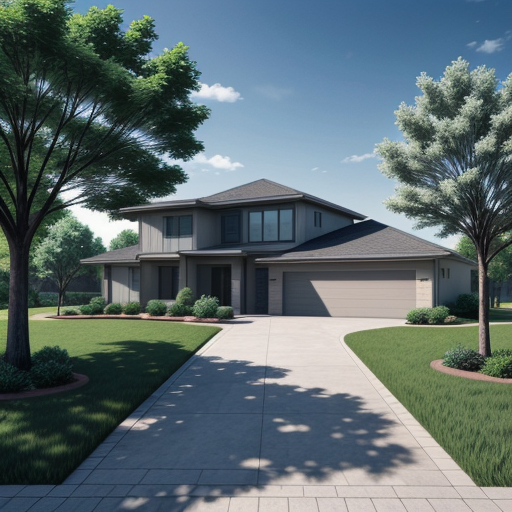

Shop around for the right property that can be financed with a VA loan. The property must meet the VA’s minimum property requirements (MPRs) to ensure it is safe, sound, and sanitary. A VA appraisal will be required once you've found a home, ensuring the property is worth the purchase price and meets MPRs.

Understanding VA loan entitlements is also crucial. These entitlements can affect how much you can borrow without a down payment. While the basic entitlement is $36,000, you may receive additional entitlements based on location and loan limits.

Finally, be aware of the VA funding fee, which helps keep the program running. This fee can be financed into the loan amount and varies based on your service, down payment, and whether it’s your first VA loan or a subsequent one.

With the right preparation and guidance, VA loans can provide an excellent pathway to homeownership for veterans, often with more favorable terms than conventional loans. This guide aims to simplify the process and empower you with the knowledge needed to confidently navigate the VA loan journey.